Everyone is wrestling with ways to save money, and a mortgage calculator can help you accomplish this goal. You might not have heard about it wonderful tool before, but it can certainly help you when you are waiting for a mortgage. Whether you are a first time buyer, or an experienced veteran, you make use of this calculator which means you can get the interest rates and premium.

Now, if there can also be interest rate charges around the market that you are considering, you should use the tool to see just exactly what the difference in order to. Simply go back towards blank Mortgage Calculator and input the important information for the new potential home loan. You will get all the same numbers, this time with brand new totals for that new offers. Because there is no charge for in such a tool plus there is no obligation for using it, it is simple to keep using it to keep seeing the various options which are.

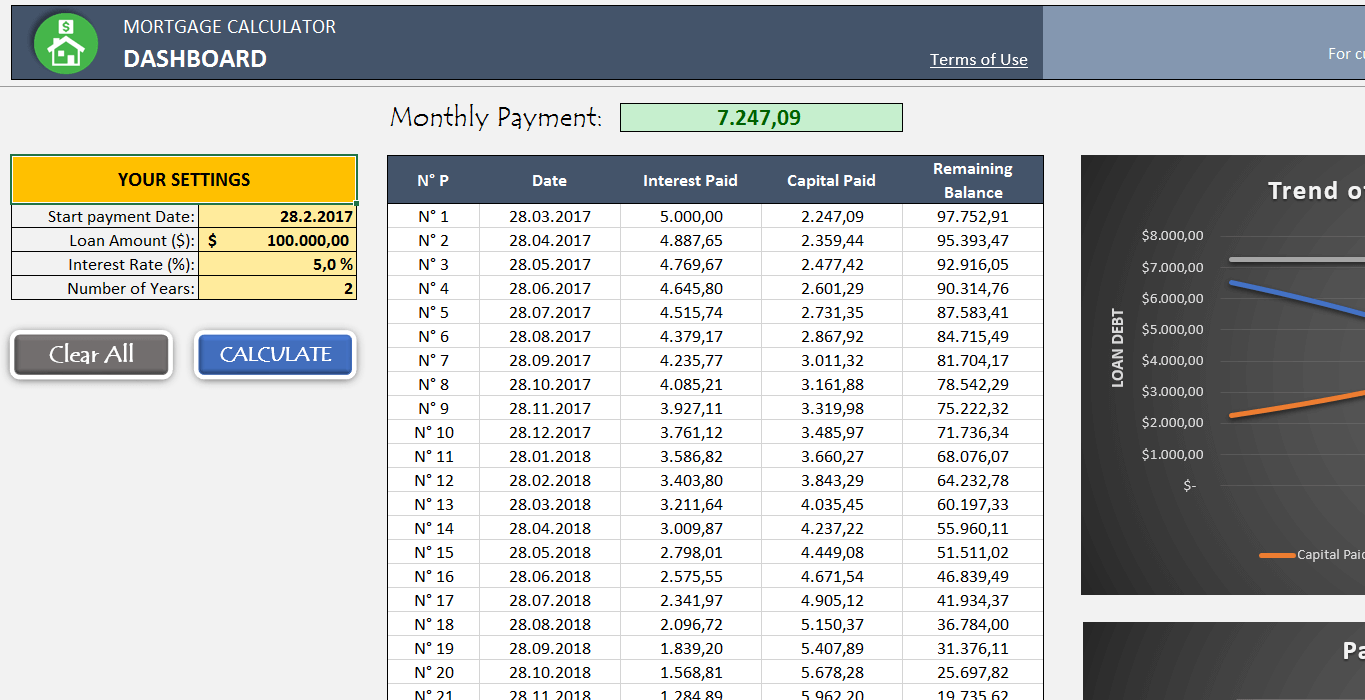

For instance, if you employ a 250,000 loan with nine.5 percent interest over a 30-year term, you will expend 1748.04 per month repaying the loan. If this sounds affordable, a person definitely might forget to consider how much you will pay in interest. Over the life of the loan, the interest rate that shell out will equal 379,293. In other words, that 250,000 home will really cost you about 629,000. Suddenly, that mortgage may possibly look so excellent.

I would run somebody through not less than one more mortgage loan calculator, in order to validate that company. Then I Mortgage Calculator Toronro would repeat methods to reduce for my second mortgage amount. Of course, your current products can manage to put 20% down in order to avoid the second mortgage scenario, the math is simpler.

I would run these numbers through quite one more mortgage loan calculator, in order to validate him or her. Then I would repeat the operation of for my second mortgage amount. Of course, seeking can afford to put 20% down avoiding the second mortgage scenario, the math is easier.

However, once the 5 years is up you get all the 30 years worth of principal squeezed into the 25 years that possess to left on your mortgage. Plus, it's a flexible rate and who knows what could happen to interest percentage in improved. So you'll have to include principal and adjust your rate of interest to almost double your mortgage payment for the other 25 seasons.

You may use these calculator for car or truck loan, mortgage loan and a credit card loan. They will show you quickly you're going to pay them off and the way that quickly vital pay them off with extra crucial. It's best to pay the longer term loans first because you're paying the most interest built in.